“An entrepreneur,” LinkedIn founder Reid Hoffman once said, “is someone who will jump off a cliff and assemble an airplane on the way down.”

As a startup owner, you must embrace your inner MacGuyver. You need to do what you can with what you have to get to where you want to go. To the outside world, you’re making a leap of faith—a reckless, crazy jump. But you’re more calculating than it appears. You understand that total security is impossible and that embracing uncertainty has benefits, not just costs.

But bounding this risk is tricky. For instance, on the one hand, you must watch cash flow like a hawk. On the other hand, you must spend to recruit great people to bring your vision to life. So how do you attract excellent talent if you don’t have cash to pay them upfront?

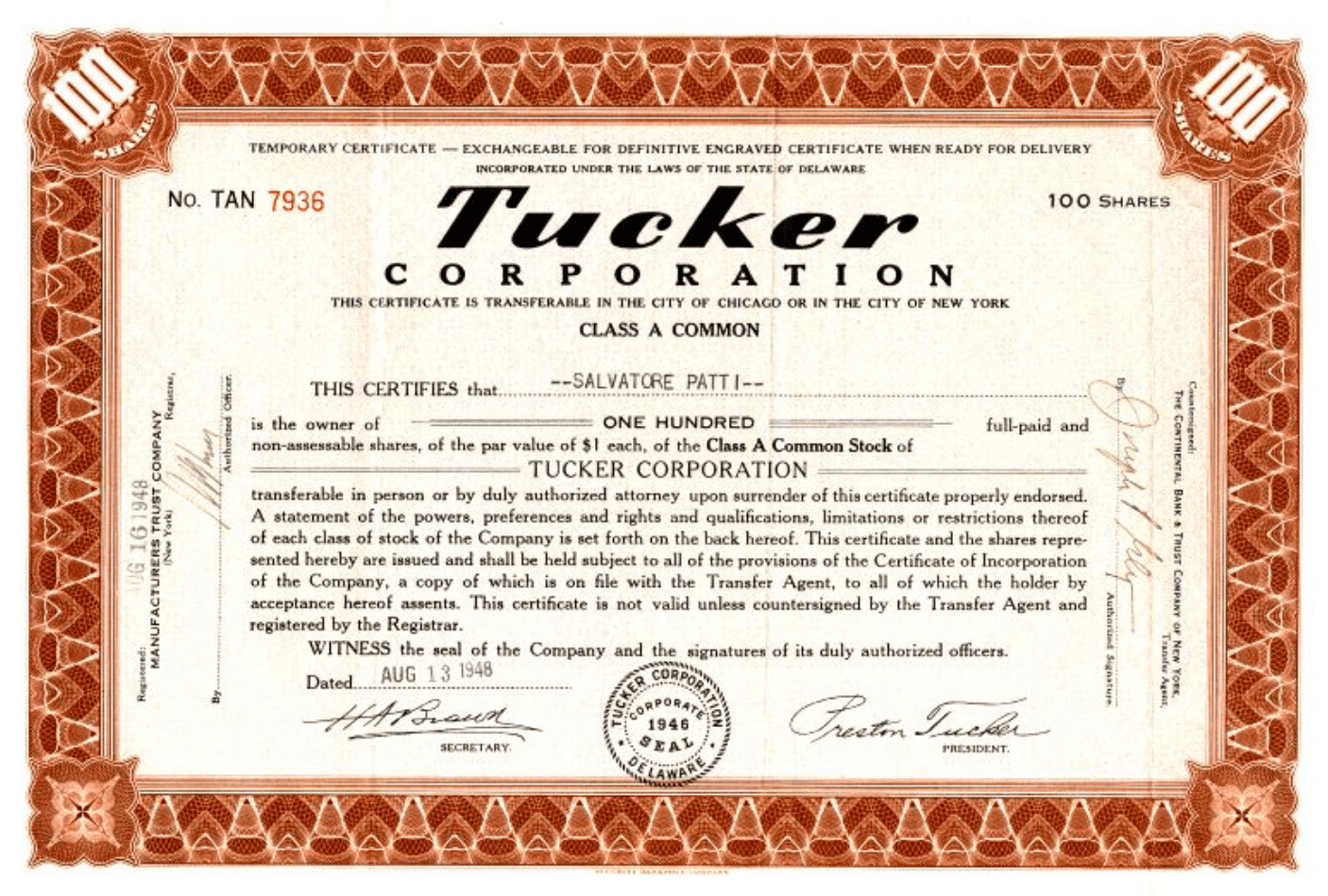

Many entrepreneurs turn to stock options to recruit and retain people. Stock options give you the right to purchase a set number of shares in the future at a lower price today. They can attract, retain, and motivate talented employees to strengthen your startup and increase its value. Before you decide whether to issue stock options to your team, review these FAQs:

1. What ‘Options’ Do I Have?

There are two basic kinds. The first is called a Non-qualified Stock Option (NSO); the second is an Incentivized Stock Option (ISO). The differences relate to whom they can be issued to and how they are taxed and regulated.

You can grant an NSO to anybody. Many employers offer them not only to employees but also to consultants. The recipient can be taxed twice: first, when she exercises the option and again when she sells the stock, with the difference between the exercise price and the fair market value of the stock taxed as ordinary income.

ISOs are reserved exclusively for your employees. When you sell this stock, you must pay long-form capital gains taxes. Additionally, under Section 422 of the Internal Revenue Code:

—ISOs are only transferrable when the ISO holder dies,

—They can be only be exercised on stock worth up to $100,000 every year,

—The recipient must be given an exercise price at premium over the fair market value if she owns more than 10 percent of the company.

Many companies prefer to issue NSOs, because when employees exercise their stock options, the company can claim a tax deduction. Overall, many business owners say NSOs are easier to administer.

2. How Do I Issue Stock Options?

An experienced attorney can draft a stock option plan–applicable to all–as well as stock-option purchase agreements for each selected employee.

This plan should explain the terms and conditions of the stock option deal, and the agreements should detail the stock options granted, the vesting schedule, and other information specific to the chosen employee.

3. How Do I Set Value/Prices?

The stock options you grant must have an exercise price equal to or greater than the fair market value. You can figure out fair market value by obtaining an independent appraisal. If your company is an “illiquid start-up corporation”, you may be allowed to rely on the advice of someone who has significant experience performing similar valuations, if eligible.

Mind the details! Mistakes made in stock options documents can be costly, because stock options are considered securities and are thus subject to the securities law and the enforcement actions of the U.S. Securities an Exchange Commission (SEC).

A violation of these laws could trigger right of rescission for the stock options holder (i.e., the right to get their money back), fines and even possible criminal prosecution.

4. How Many Stock Options Should I Offer to Employees?

The answer depends on your company’s stage of development. Seed stage, or pre-series A round, may be the best time to hand out stock options to keep and motivate talented employees.

Be mindful of offering too much equity. The bigger the stock option pool, the more your own share gets diluted.

For similar reasons, you also need to avoid giving too much away to venture capitalists. (Note that venture capitalists and investment funds typically require 15-20 percent of the post-money capitalization—with all employee stock options factored-in—before they’ll get involved.)

5. What Is a Vesting Schedule and What Should It Look Like?

This time frame establishes how long employees must work for you before they can exercise their stock options. The most common period for full vesting is four years.

Many startups require employees to work for at least one year from the date of the initial option grant (called the one-year “cliff”) before 25 percent of their stock options vest.

After the cliff, employees generally receive the remaining stock options on a quarterly basis. That way, by the end of year four, all the options have vested.

6. What If I Have to Fire an Employee Who Has Options?

To protect yourself and the startup, consult with an experienced attorney. You need to be extremely careful.

To avoid issues, many companies write their stock option purchase agreements with language that says terminated employees are not entitled to pro rata vesting after termination with or without reason and can be terminated at any point before the vesting date.

7. What Is Restricted Stock?

As its name implies, restricted stock is constrained. For instance, it may be limited by a vesting schedule.

Used strategically, restricted stock motivates employees to think like co-owners. It can be less expensive to structure and less burdensome to monitor than stock options. And you can use a vesting schedule with restricted stock, too.

While restricted stock can be useful when a company’s valuation is low, it can lose its appeal as the valuation increases. The employees must either buy the stock outright or have the value of the stock received be considered taxable income. In Facebook‘s case, the company agreed to take on their employees’ tax burdens: It cost them up to $2 billion!

Additionally, some important tax implications arise with restricted stock. These issues are usually resolved by making an 83(b) election.

Powerful Examples

Tales of employees becoming rich after investing in risky startups frequently make headlines. For an extreme example, consider graffiti artist, David Choe. Back in the early days of Facebook, the founding team wanted to paint a mural at their headquarters. In what seemed like a frugal move, President Sean Parker decided to pay Choe to do this work in exchange for stock options.

“Choe was added on as an “adviser” [to Facebook] and received 0.1 to 0.25 percent of the company.” When Facebook later went public, Choe’s shares were worth close to $200 million. (Amazingly, prior to the IPO, Choe was homeless and living on the streets—quite a turnaround!)

Jim Payne of MoPub also paved the way to make his initial believers wealthy. Twitter bought his startup in 2013 for $350 million, minting 36 new millionaires in the process.

“Payne set his employees up for success by getting them stock early, offering performance-based stock-option grants regularly … MoPub offered employees loans so they could exercise their stock options — long before an acquisition deal was on the table — to save money on taxes. The company-issued loans allowed employees to buy options at low prices and begin capital gains treatment without taking big personal, financial risks.”

Chiobani Yogurt also understood the value of stock options and recently made splashy headlines with a decision to create co-owners out of thousands of employees.

“CEO and Founder Hamdi Ulukaya told the company’s 2,000 full-time employees at its Upstate New York plant Tuesday they’ll receive shares worth up to 10% of the company’s value when it goes public or is sold. “This isn’t a gift,” Ulukaya said in a letter to employees obtained by USA Today. “It’s a mutual promise to work together with a shared purpose and responsibility. To continue to create something special and of lasting value.”

Motivating the Right People the Right Way

When you’re in the early phases of a venture, you find yourself falling back on your resourcefulness/grit more often than you’d like to admit. How do you escape this cycle? Answer: you must find a way to recruit great talent.

Paying out of pocket is not the only way to go. Get creative, and explore how to incentivize and reward your employees and consultants.

Stock options, either as ISO or NSO, are powerful tools. Used wisely, they preserve your cash and generate buy-in for the mission without diluting your ownership stake too much. However, you need to understand the obstacles in your way (such as watering down your share or exposing your company to SEC actions later); the differences between ISO and NSO; and the alternatives to stock options, such as restricted stock.

The startup lawyers at Buchwald & Associates can help you chart a strategic course based on your mission, your cash flow, your team and your goals. Call us to get the insight you need. We can help you move beyond the MacGuyer stage and create the structures and processes you need to win.